Threepoint

Veteran Member

- Joined

- Feb 13, 2014

- Messages

- 2,232

- Location

- No. VA

- Tractor

- Kubota B2150HST w/ LA350 loader, Kubota GF1800 HST, Kioti CK3510SE HST w/ KL4030 loader, Kioti NX4510HST/cab w/ KL6010 loader

Quote Originally Posted by Travelover:

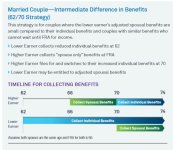

"I want to make sure my wife is covered after I die, so she will take it at 62, I will take spousal (half her amount) at 66, then take my full at 70. When I die, she gets my amount. If she should die first, I'd still get the higher amount."

Quote Originally Posted by Threepoint:

"One thing not yet discussed in this thread is the SS strategy known as "file and suspend." .........."

Actually that is exactly what I described in my post shown above, though I didn't use the term. And the age for maximum benefits is 70. Age 70 1/2 is when you are required to take minimum required distributions (RMDs) from your IRA and 401(k) accounts.

Travelover, I certainly didn't intend to offend you with my post (#30) on "file and suspend." I wasn't even thinking of your post (#18) at the time. Having gone back and looked at it though, what you describe is not at all what I understand to be the file and suspend strategy, sometimes also called claim and suspend. I'm no expert on SS (didn't even stay at a Holiday Inn Express last night), which is why I linked to the SS website rather than try to explain the strategy in my post. There are several third-party sites that also explain it better than I could. What you described seems to be some variant of the "62/70 split" strategy. Maybe it will work for you; fishheadbob seems to think it won't. But in any event I don't want to quibble with any fellow TBNr on this, nor do I think other members want to wade through that. :no:

You are right that maximum SS benefits are obtained by waiting until age 70, not 70-1/2, the age when the MRD requirement kicks in.