oldpilgrim

Elite Member

"Across the U.S. Midwest, the plunge in grain prices to near four-year lows"

I'm not a farmer but I know a lot of people here and in VT who are, and it's not an easy profession.

It seems like the average home based farmers are purposefully being squeezed out by the 'mega' farms and the govt.

A few years back, cattle and dairy farms were made 'offers they can't refuse' to sell/kill all their cattle and promise not to go back into the business for X years in return for a whole lot of cash. The offers were too good to refuse. There were many farms within just a few miles of me that did it.

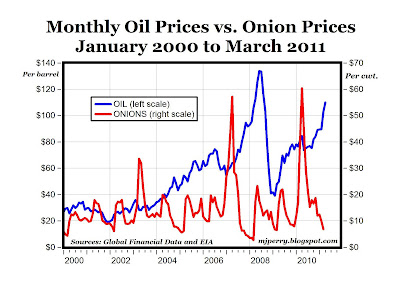

That being said, the 'plunges' in grain prices never seem to be reflected in the grocery stores. I wonder why

I'm not a farmer but I know a lot of people here and in VT who are, and it's not an easy profession.

It seems like the average home based farmers are purposefully being squeezed out by the 'mega' farms and the govt.

A few years back, cattle and dairy farms were made 'offers they can't refuse' to sell/kill all their cattle and promise not to go back into the business for X years in return for a whole lot of cash. The offers were too good to refuse. There were many farms within just a few miles of me that did it.

That being said, the 'plunges' in grain prices never seem to be reflected in the grocery stores. I wonder why