You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Global Warming?

- Thread starter Bird

- Start date

- Views: 358459

- Status

- Not open for further replies.

More options

Who Replied?

/ Global Warming?

#1,311

Loren49

Veteran Member

How much energy is in 15 gallons of gas? Explosion! We seem to take the risk. With larger vehicles its 40 gallons.

Loren

Loren

Loren49

Veteran Member

The industry is growing but not without growing pains. Same was true of the gas powered auto. There were no gas stations.:confused2:

Future electric car roundup: Our most anticipated EVs of 2012 and beyond | Digital Trends

The Future Of Electric Vehicles: Who? Where? When? How Much? How Many? | The Truth About Cars

Loren

Future electric car roundup: Our most anticipated EVs of 2012 and beyond | Digital Trends

The Future Of Electric Vehicles: Who? Where? When? How Much? How Many? | The Truth About Cars

Loren

Anti-Hype In Lithium-Ion Batteries Foretells Doom For Electric Cars

Despite billions of dollars in private investments and public subsidies, lithium-ion battery technology has progressed at a snail's pace for years and battery developers have recently started to emphasize the importance of baby steps. For the first time in memory, anti-hype is becoming a dominant theme in stories about lithium-ion batteries.

Examples from this month include:

An interview with Wards Auto where the business manager of the DOE's Kentucky-Argonne Battery Manufacturing Research and Development Center explained that it takes about ten years to put a battery innovation into production and all of today's EVs are powered by technologies that were developed at least a decade ago.

An article from National Defense which predicts that lithium-ion battery research will soon hit a brick wall because batteries can only be as small and lightweight as their materials allow and immutable laws of physics and chemistry limit the number of electrons that can be stored in a given mass of battery material.

An article in Nature that discussed ways nanotechnology can improve battery performance by increasing surface area, but took pains to explain that nano-materials must be produced in carefully controlled environments and the high cost of manufacturing nano-materials usually outweighs the benefits derived from using them.

An article in Design News that focused on the harsh reality that battery development is hard, slow work because batteries require a wide variety of costly materials to work together as a system; there are limitless ways that things can go wrong; and throwing loads of money at research can't make progress happen overnight.

An article in Waste Management World that explains the complex technical and economic challenges that must be overcome before lithium-ion battery recycling can progress beyond a few pilot plants and become a cost-effective industrial reality, as opposed to a hopium-laced talking point.

An article in the MIT Technology Review that reads like a premature obituary as it discusses the triumphs and tragedies at A123 Systems (AONE) and their ongoing search for strategic alternatives.

My personal favorite is a strategy memo from the National Alliance for Advanced Technology Batteries that focuses on the problems at A123 Systems and the failures of Ener1 (HEV) and International Battery. It's classic spin control that ultimately blames the debacle on government policy. Since the irony is so rich, I'll annotate the last three paragraphs by highlighting text that I find particularly entertaining in bold type and adding some observations [in brackets].

"If criticism intensifies, which is likely, it will be important to communicate an important point: Government funding of new energy technologies is meant to support those technologies, not the companies that develop them [or the investors who bought the hype that's part and parcel of government support]. The failures of Ener1 and International Battery, and the troubles of A123 Systems, are business failures, not technology failures. Companies come and go. Corporate assets get bought, sold and reorganized [while investors lose their shirts]. None of that should matter to taxpayers. What should matter is whether the technologies that A123 and Ener1 owned at the time they received their grants has been advanced and pushed closer to commercialization [while politicians promised cost-effective products]. Indications in both cases are that they have been [but unsubsidized demand hasn't materialized].

If the FOA-26 program can be criticized for anything it is that the program focused on funding immediate deployment of advanced automotive battery technology rather than its longer term development. Many pointed that out at the time [and we were lambasted as neo-luddites]. The [entirely predictable] problems at A123 Systems and the failures of Ener1 and International Battery are powerful testimony to the fact that the market for that technology in 2009 was critically immature [just like the underlying technology]. A better use of the funds would clearly have been investing them in the development of new, next-generation battery technologies that could facilitate the development of a market for advanced automotive batteries in the future rather than cater to one that did not fully exist.

In fairness to the Department of Energy, the emphasis on immediate deployment and å*µetting shovels in the ground was a political directive motivated by a critical economic crisis, not a considered policy decision. As a consequence, DOE funding of advanced battery technology over the past three years has not been as efficient as it might have been. But that is not to say that it has been a failure. Steady progress on increasing energy density, decreasing battery cost and improving battery system management continues to be made [at a snail's pace]. The market we hoped for in 2009 is not here yet and some of the original players in the market may not make it to the finish. But that market is substantially closer than it was three years ago, and by that fact the success or failure of the FOA-26 program is more properly judged."

The core message of this new anti-hype campaign is clear. The promised improvements in lithium-ion battery technology have not materialized and they're not likely to evolve from existing technology and architecture. We may see a doubling of energy density over the next decade, but the six- to seven-fold gains that Energy Secretary Chu has called for are not possible with current technology. The dream of quantum leaps in performance accompanied by precipitous cost reductions is not in the cards, or for that matter on the horizon. Breathless promises of cost-effective electric cars that will clear the air and deliver us from the tyranny of oil dictators are snake oil cures that will enrich the hucksters for a time, but end in tar, feathers and a ride out of town on a rail.

Battery mythology developed for the sole purpose of supporting electric car mythology. Battery developers tried mightily and failed. Now battery developers are seeking shelter from the backlash that inevitably comes back to haunt companies and industries that promise more than they can deliver. The next dominoes are companies like Tesla Motors (TSLA) that can't possibly build cost-effective electric vehicles without better and cheaper batteries. Tesla may survive for a time by making toys for the ideologically committed and mathematically challenged rich, but the congenital birth defect that's doomed every generation of electric cars to the scrap heap remains.

The electric car industry can't survive without a thriving and profitable battery industry that can make products that meet or exceed expectations. The battery industry is on record saying they can't meet the ambitious goals they embraced in the recent past. Things might change in my lifetime, but the change is not going to happen in the next decade. Meanwhile the real auto industry is digging into its toolbox and rapidly implementing technologies that weren't cost-effective in another economic era but are today.

Anti-Hype In Lithium-Ion Batteries Foretells Doom For Electric Cars - Seeking Alpha

Petersen is a lawyer, his article is based on profit not technology. His perspective of batteries is with respect to the monetary (read investment) viability of EVs. He doesn't have a crystal ball into the future of battery technology (or a background in it), PV charging technology or future developments. He never mentions super capacitor technology or the fact that EVs are now going over 100 miles per charge. He doesn't mention the rapidly rising PV usage (because of much lower cost of PVs) in this country to charge those EVs, the pollution of ICE vehicles and the pollution bringing oil to stations or markets. His analysis is completely from the perspective of profit:

" While I might have a bone or two to pick on the fine points, your comment is a breath of fresh air because it focuses not on the joys of owning a product but on the potential risks and rewards of investing in a stock. As far as I'm concerned the former has no place on Seeking Alpha, a site dedicated to investors who want to make money. "

John Petersen

Lithium battery technology has made some major steps in energy density. We're seeing the transition from Cadmium with its memory problems, short life and low recharge cycles numbers to Li-ion more and more.

Everyone here who has a laptop has lithium technology and chip manufacturers have contoured charging algorithms to maximize those batteries. As electrolytics keep getting better they will augment battery technology and very possibly replace it.

Rob

Last edited:

Dark Clouds Threaten German Clean Energy Ambitions: Global Implications

During the fourteen years that I've lived in Switzerland, the Germans have been the world's staunchest supporters of green power and alternative energy. Their aggressive development of wind power was breathtaking, as was their warm embrace of photovoltaic power. Over the last few weeks, however, there has been an ominous change in the mainstream German media's tone as the political class finally comes to grips with the unpleasant reality that rooftop solar panels are worthless on short, gray winter days and "For weeks now, the 1.1 million solar power systems in Germany have generated almost no electricity." Three recent and highly negative articles from Der Spiegel Online include:

Solar Subsidy Sinkhole; Re-evaluating Germany's Blind Faith in the Sun;

Solar Subsidy 'Insanity' Will Cost Consumers; and

Solar Energy Row is an 'Undignified Spectacle'

As recently as last year, articles like these would have been unthinkable. Today they're viewed as reasonable discussions of critical issues as the laws of thermodynamics and economic gravity assert their absolute primacy.

The Germans have been trailblazers in all things green since the emergence of the Green Party in the 1980s. In fact, it's hard to name an alternative energy technology that Germany hasn't welcomed with open arms. When it comes to green power and alternative energy, the Germans have been on the far left of the technology adoption curve for a very long time.

1.24.12 Tech Lifecycle.png

If the tone of the recent Der Spiegel articles is a reasonable indicator of public sentiment, the innovators are getting ready to throw in the towel on green panacea solutions and get down to the serious work of conserving energy instead. They're weighing the costs and benefits, and reaching an entirely predictable conclusion that it's impossible to depend on variable and inherently unreliable power sources as the backbone of an industrial economy. As Germany goes, so goes the world.

If the world's standard-bearer for green power and alternative energy abandons the quest and chooses a more sensible path of conservation and energy efficiency, the backlash against the solar power industry will be immense and risks to the wind power industry will skyrocket. After all, it's hard to argue the merits of "One for the Price of Two" power solutions; which is exactly what you get when wind and solar power have to be fully backed up by conventional power plants. If the solar and wind power dominoes fall, they'll almost certainly take out the emerging electric vehicle industry that demands huge amounts of money and natural resources to simply substitute one fuel source for another.

Currently all eyes are on Germany as the epicenter of European efforts to restore fiscal balance in an age of profligate and unsustainable government spending. The apparent German surrender on green power and alternative energy may just be an unfortunate victim of that broader effort. Until the dark clouds dissipate and we have a clearer view of the landscape, I'd minimize my exposure to solar, wind and electric drive and focus instead on less costly energy efficiency technologies that work with the laws of thermodynamics and economic gravity instead of fighting them.

Dark Clouds Threaten German Clean Energy Ambitions: Global Implications - Seeking Alpha

Ill say this again; Alternatives are people power, they work best in applications such as mine where individual autonomy is reached. What is the price of independence from oil? Who has that figure? Who can tell me what the cost of the wars to protect that energy are? The cost to clean up its pollution, spills, etc? The corporate power and control of countries oil gains for the few?

If we are going to look at Germany we also have to look at Japan, now implementing PV and Wind. Done right the two compliment each other, combined with other forms of energy harvesting like wave technology they will provide a seamless energy grid in the future.

What they can't provide is for excess. I see a lot of noise about alternatives not covering the excesses of society. We have to change how we live on this planet and that's the rub, we want to keep living with our foot to the floor, lawyers like Petersen myopically exist in a bubble of monetary gain. Get cancer from coal pollution and tell me what your monetary gain is doing for you!

We forget the real power is in the land, money is just paper. Petersen very likely has no idea what it takes to grow a head of cabbage, too bad, he is misfunctionally dis-joined with respect to the environment that feeds him and supports life. Let's not forget that last statement, "SUPPORTS LIFE" , that's not money that's the air we breathe.

Rob

Can hardly wait to get me a car powered by these batteries.

Maybe a Chevy Volt so I can collect on my fire insurance.

You missed you chance, you should have bought a Pinto with the exploding gas tank a few years back!

Rob

My hat goes off to Germany, they are trying to change the way we harness and utilize energy on this planet.

Let's understand that renewables are in their infancy, the changes that have been made in the last 10 years have been substantial. The cost of alternatives have been dropping significantly also and I think this is putting pressure on the fossil fuel industry with their rising fuel costs. Now everyday people are coming to me and when they see what can be done and the independence I have gained they want more answers and more solutions.... that's a good thing.

Some of the questions I get are so off the mark, so riddled with misinformation and bad media that it creates disbelief in people when they see how wrong their formed preconceptions are.

Change is on an individual basis, we want someone else to figure it out, to come up with a silver bullet. It is our individual responsibility to resolve the problems we face.

We can certainly stick our heads in the proverbial sand but that never fixes anything. We can live with fossil fuel, which really is a monster that feeds a few wealthy individuals at the expensive of the masses and democracy, but that can only last so long.... as much as we let it. What we have as individuals is the power to purchase and when we don't purchase a product corporate thinking will change to accommodate us. That's a tremendous amount of power.

"Massive change is entirely dependent upon individual action"

MK Gandhi

Let's understand that renewables are in their infancy, the changes that have been made in the last 10 years have been substantial. The cost of alternatives have been dropping significantly also and I think this is putting pressure on the fossil fuel industry with their rising fuel costs. Now everyday people are coming to me and when they see what can be done and the independence I have gained they want more answers and more solutions.... that's a good thing.

Some of the questions I get are so off the mark, so riddled with misinformation and bad media that it creates disbelief in people when they see how wrong their formed preconceptions are.

Change is on an individual basis, we want someone else to figure it out, to come up with a silver bullet. It is our individual responsibility to resolve the problems we face.

We can certainly stick our heads in the proverbial sand but that never fixes anything. We can live with fossil fuel, which really is a monster that feeds a few wealthy individuals at the expensive of the masses and democracy, but that can only last so long.... as much as we let it. What we have as individuals is the power to purchase and when we don't purchase a product corporate thinking will change to accommodate us. That's a tremendous amount of power.

"Massive change is entirely dependent upon individual action"

MK Gandhi

rsewill

Veteran Member

100 miles on a charged lithium ion battery powered car is enough for most people's daily use if it is a second car. It would work just fine for my family and our next car will be electric-only.

crash325

Elite Member

You missed you chance, you should have bought a Pinto with the exploding gas tank a few years back!

Rob

The Pinto caught fire in a rear end collision. Not just sitting in the garage after being parked.

If I understand your argument on Germany & Japan. The Germans were not smart enough to do it correctly. But Japanese will get it right.

Coal plants are causing so much cancer, the people in Southern AZ all going to die. I live 35 miles from a coal plant in down town "Tucson and my vehicles are Smog Except. Cochise County SW of Tucson, has no smog inspections.

Good Chance cancer rate & deaths are pretty high around here. Old people come here to retire and sick people come here for health reasons.

I know the item below is about 5 years old and some things have come down in cost and some of the technology has improved. But other things have gone up in cost, Steal, Copper & Aluminum.

Understanding the Cost of Solar Energy

August 13th, 2007

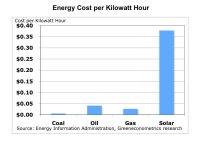

In comparison to conventional hydrocarbon fuels such as coal or oil in generating electricity, the cost of solar energy is significantly higher. To compare energy cost, a common equivalent is required. Back in our previous post, Coal: Fueling the American Industrial Revolution to Today痴 Electric, we developed a framework to measure energy costs by converting costs to kilowatt-hours (KWH).

In our example, a ton of coal on the average produces approximately 6,182 KWH of electric at a cost of about $36 per short ton (2,000 pounds). Under this measure coal cost less than$0.01 per KWH. In comparison, a barrel of oil at $70/barrel produces 1,700 KWH at a cost approximately $0.05 per KWH. Let痴 provide some measures to understand energy costs.

Energy Units and Conversions KEEP

Energy Comparison

1 ton of coal = 6,182 KWH

1 barrel of oil = 1,699 KWH

1 cubic foot of gas = 0.3 KWH

Energy Costs

1 ton of coal costs $36 = $0.006 per KWH

1 barrel of oil costs $70 = $0.05 per KWH

1 cubic foot of gas $0.008 = $0.03 per KWH

In comparison to solar energy, the hydrocarbon fuel costs are significantly lower without rebates, tax benefits nor the cost of carbon emissions. A two訪ilowatt (KW) solar energy system costs about $45,000 and covers roughly half of a typical American household痴 energy needs. At $45,000, a solar energy system equates to $9,000 a kilowatt. The $9,000 per KW for solar is not very helpful in comparing electric generation costs to other fuels like coal or gas. Since coal, oil, and gas can be measured on a cost per KWH, we should measure solar costs on a KWH basis.

Some of the considerations for a solar energy system include the 20-to-30 year lifespan of the system and the hours of available sunlight. The hours of available sunlight depends on latitude, climate, unblocked exposure to the sun, ability to tilt panels towards the sun, seasonality, and temperature. On the average, approximately 3.6 peak sunlight hours per day serves as a reasonable proxy to calculate the average annual output of electric from solar energy panels.

Solar Energy Costs

Average system costs = $95 per square foot

Average solar panel output = 10.6 watts per square foot

Average solar energy system costs = $8.95 per watt

In order to compare the solar energy costs to conventional hydrocarbon fuels, we must covert the $8.95 per into KWH. Let痴 make two calculations to measure the total electric energy output over the lifespan of the solar energy system. The first adjustment is to convert solar direct-current (DC) power to alternating current (AC) power that can be used for household appliances. The conversion of DC to AC power results in an energy loss of 10 percent for a solar energy system. The second calculation is to approximate total electric output by multiplying the average peak hours of sunlight (about 3.63 hours per day) times 365 days times 20 years (the product lifespan).

For our 5-KW solar energy system costing $45,000, the conversion to KWH is as follows:

5 KW times 90% = 4.5 KW (Conversion of DC to AC power)

4.5 KW times 3.63 hours = 16 KWH per Day

16 KWH x 365 = 5,962 KWH (Average Annual Output)

5,962 KWH x 20 years = 119,246 KWH (Total output over 20 year lifespan)

So a $45,000 5KW solar energy system produces about 119,246 KWH of electric over its lifespan meaning the average cost equals $0.38 per KWH. ($45,000 divided by 119,246 KWH)

Figure 1 Cost of Energy

Energy Costs

The relatively high solar energy costs in comparison to conventional fuels should improve with utility rebates and government tax incentives. In addition, solar panel prices should continue to decline as volume production increases. Solar cell manufacturers employ similar production methods as semiconductor suppliers and benefit from economies of scale.

There are several components of a solar energy system. Solarbuzz provides some detailed information on solar industry pricing. Solarbuzz

The single largest cost is the solar panels themselves. The following figure provides an overview of the components of a solar energy system. Sharp Solar provides a very useful calculator for system costs and electric generation by geographical location along with utility rebates for your area. Sharp Solar Energy

Figure 2 Solar Energy Component Costs

Component Costs

We will explore the some of the advances in thin-film technologies, the declining costs of solar panels, and the improving solar conversion efficiencies that should continue to bring solar energy costs on par with hydrocarbon fuels. With the improving cost structure of solar and a better understanding of the cost of carbon emissions from hydrocarbon fuels, we may find a more level playing field in comparing energy costs

Attachments

The Pinto caught fire in a rear end collision. Not just sitting in the garage after being parked.

If I understand your argument on Germany & Japan. The Germans were not smart enough to do it correctly. But Japanese will get it right.

Coal plants are causing so much cancer, the people in Southern AZ all going to die. I live 35 miles from a coal plant in down town "Tucson and my vehicles are Smog Except. Cochise County SW of Tucson, has no smog inspections.

Good Chance cancer rate & deaths are pretty high around here. Old people come here to retire and sick people come here for health reasons.

I know the item below is about 5 years old and some things have come down in cost and some of the technology has improved. But other things have gone up in cost, Steal, Copper & Aluminum.

So you want to buy a Pinto and hope you don't get in an accident? Help me out here. My friend parked a Ford in here attached garage, it burned down here house, feel better?

Germany took the lead, yes there were mistakes as with any new endeavor, it has nothing to do with smart. When Newton was asked how he accomplished so much he said, "I was standing on the shoulder's of giants" which was a tribute to all those scientists who preceded him. Will Japan do it better? Logic would say so.

Today, before incentives, you can buy PV modules for under $1.50 a watt. To say prices have come down in cost is an understatement.

Study links stream pollution to higher cancer rates - News - The Charleston Gazette - West Virginia News and Sports -

Study links stream pollution to higher cancer rates

By Ken Ward Jr.

The Charleston Gazette

Advertiser

CHARLESTON, W.Va. -- West Virginians who live near streams polluted by coal mining are more likely to die of cancer, according to a first-of-its kind study published by researchers at West Virginia University and Virginia Tech.

The study provides the first peer-reviewed look at the relationship between the biological health of Appalachian streams and public health of coalfield residents.

To dismiss alternatives is to dismiss technology, you didn't do that when you bought your computer but you want to do it with PV?

You want to dismiss the satellites that run on PV that enable TBN?

Let me know where you want to go with this?

Rob

- Status

- Not open for further replies.