smstonypoint

Super Member

- Joined

- Oct 13, 2009

- Messages

- 6,119

- Location

- SC (Upstate) & NC (Piedmont)

- Tractor

- NH TN 55, Kubota B2320 & RTV 900, Bad Boy Outlaw ZTR

If you haven't finished your Federal income tax return yet, you had better "git er done."

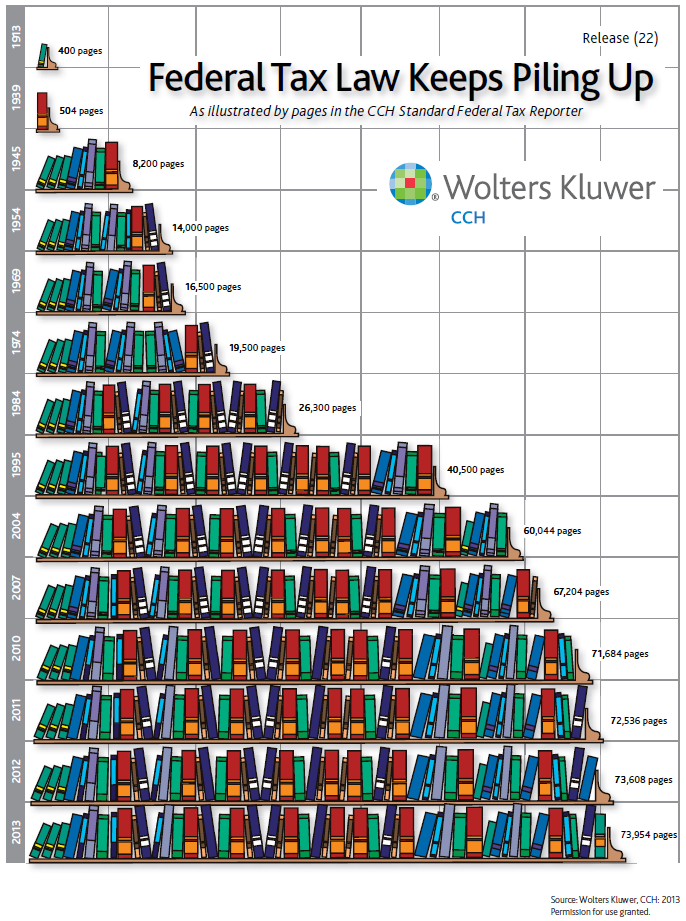

Here's an interesting graphic from Political Calculations: 2014: How Many Pages in the U.S. Tax Code? showing how the Federal tax code has changed since ratification of the 16th Amendment.

From Mark Perry: Tax deadline is approaching next Tuesday: Bring us back to 1913 (or better yet, bring us back to pre-income tax 1912) | AEIdeas

Have fun this weekend.

Steve

AMENDMENT XVI Passed by Congress July 2, 1909. Ratified February 3, 1913.

Note: Article I, section 9, of the Constitution was modified by amendment 16.

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

The Constitution of the United States: Amendments 11-27

Here's an interesting graphic from Political Calculations: 2014: How Many Pages in the U.S. Tax Code? showing how the Federal tax code has changed since ratification of the 16th Amendment.

From Mark Perry: Tax deadline is approaching next Tuesday: Bring us back to 1913 (or better yet, bring us back to pre-income tax 1912) | AEIdeas

In a recent report to Congress, the National Taxpayer Advocate estimated that American taxpayers will spend 6.1 billion hours this year complying with the income tax code, based on IRS estimates of how much time taxpayers (both individual and businesses) spend collecting data for, and filling out tax forms. That amount of time spent for income tax compliance 6.1 billion hours would be the equivalent of more than 3 million Americans working full-time, year-round (or 2.2% of total US payrolls of 138 million). By way of comparison, the federal government currently employs 2.7 million full-time workers, and Wal-Mart, the world's largest private employer, currently employs 2.2 million workers worldwide and 1.4 million workers in the US (both full-time and part-time).

In the beginning when the US federal income tax was first introduced in 1913, it used to be a lot, lot simpler and a lot easier to file taxes; so easy in fact that it was basically like filling out your federal tax return on a postcard.

For example, page 1 of the original IRS 1040 income tax form from 1913 appears above. There were only four pages in the original 1040 form, including: two pages of worksheets, the actual one-page 1040 form above, and only one page of instructions, view all four pages here. In contrast, just the current 1040 instructions for 2013, without any forms, runs 207 pages.

Have fun this weekend.

Steve

Last edited: