I retired four years ago after a 28 year career at the same company. I was 54 at the time, fed up with mismanagement of the pension and other benefit plans, and fearful that the longer I waited the more the retirement package would suffer. I've always been a budgeter, I track all my expenses in Quicken and spend money toward goals instead of by impulse. To save up the down payment for my first house, I figured out how big a loan I'd need, determined what the payment would be, and started putting that much into a savings account every month. When I finally had enough for the down payment, paying the mortgage wasn't a shock to my little financial system. I always paid a little extra every month, building equity and shortening the loan. All my houses have been fixer uppers, two of which were purchased as distressed (short sale) homes. I did most of the work myself and ended up with exactly what I wanted instead of poor workmanship and somebody else's idea of what would sell. I've only had one new car in my life, purchased with my dad's cosignature when I graduated from college and left town. All the others have been used, and paid for with cash. I maintain them as well, all except for major work and tire changes. I pay off the credit card balance every month, a habit I started after paying off the balance I'd accumulated while I was in school.

I always put enough into the 401K to get the maximum company matching fund payment; anything more went into a savings account or a Roth IRA. The investment options available in the 401K weren't great, but one was Fidelity's Contra Fund, and it did very well before it became bloated with too much money. I tried a series of "investment advisors", but had nothing but bad experiences. After my dad died I started helping mom with her estate, and while dad had done well with that advisor, his replacement was young, inexperienced, and brash, and his losses showed me I'd have to take a more active roll. In '98 I saw Jim Cramer on the Today Show advising people to get anything out of the stock market that they'd need in the next five years. When I looked at my own portfolio, my advisor at the time had it 100% in stocks. I told him to immediately move half into bond funds, then put the rest in low fee stock funds at Vanguard. The advisor wasn't very happy with that, as all of his selections were from his company, and his commissions were cut by more than half. He was even less happy at his annual Christmas client dinner that year as he tried to explain the 40%-50% losses in his client's portfolios and we parted ways shortly after that. I started watching Cramer's Mad Money TV show, but wasn't impressed, so I bought and read his first book. For the first time I was reading about how the stock marked really worked, instead of some crazy chartist theory or clueless hot stock tips. The books aren't anything like the show, and I found the methodologies useful and the background information enlightening. I subscribed to Cramer's Action Alerts service, and I piggy back some of his trades but not all of them. Especially now, as being retired I don't have the time to make up losses from more speculative trades. But because of this background, I feel like I know more about managing money than before, and though I haven't made a fortune investing, I haven't lost one, either.

Something I haven't seen mentioned here yet is the Boeing Study, a correlation between retirement age and age at death. That, combined with my "work to live, not live to work" philosophy were strong motivators to retire as early as possible. People with other job perspectives may choose different paths to retirement, or avoid it entirely.

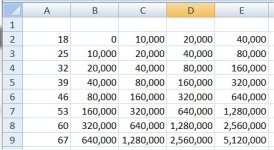

Before I retired I made up a spread sheet that tracked my living expenses, my estimated pension income, and what I could expect to receive if I sold my current home. I also attempted to make projections about ongoing expenses after retirement based on how I'd like to live, a big difference from the rat race existence of 50-60 hour weeks and steady six figure salaries. When the housing market collapsed in 2009 I really tried to sharpen those projections and started putting in cost of living figures for locations in which I'd like to live. I also asked several retired co-workers I'd stayed in touch with how they knew when it was time to retire. The best answer I got was "Oh, you'll know!".

I started looking at property in some of the areas I'd picked, and made a trip with a realtor to look at a dozen properties one weekend. The last one visited was yet another short sale, located at the end of a dead end road, perched on the side of a canyon with only one neighbor and state owned land on the two other sides. It was about 2/3 the size of my city house and in an area with a lower average income and correspondingly lower cost of living. It matched well with the "Must Have" items on my housing criteria list, but not 100%. The price was well within bounds according to the spread sheet, and after only one offer/counter offer loop, it was mine. Sadly, giving notice to my micro-managing slave driver of a boss was one of the highlights of my career.

The next few years were spent finishing/remodeling the house, taking a few trips, and keeping an eye on the budget. My biggest worry was spending more than I could afford, so my rule so far has been to spend no more than was coming in from the pension while keeping the portfolio balance flat or slightly increasing. Some years are better than others in the stock market, so my spending on big ticket items tracks the performance of the portfolio. That means some years I have had to put off things like a new driveway or, as is the case now, building a shop, but in other years I've been able to make up for lost ground. I think the most important thing I've done is to live pretty much the same way I did while I was working, at least in terms of spending on fun/luxury items. I've had some nice vacations, but I haven't splurged on new cars, extravagant remodeling upgrades, or round-the-world tours. For example, these days I drive around in a 2000 Ford F250 purchased used with proceeds from the BMW 5 series garage queen it replaced. Now that the remodeling is done, I've had time to rebuild an old motorcycle and start on another one, something I enjoy doing now that there's no hurry to finish. This winter I'm heating with a wood stove for the first time, so I'm warmer than in the propane forced air days and healthier, too. I've lived long enough to know that life will always be full of surprises, but I feel like I have more understanding and control over both my time and financial situation than ever before, which I now understand was my main reason for retiring in the first place.

It sounds like the OP is asking a lot of the same questions I did and has made some good financial decisions, too. My advise would be to understand what motivates you in life and how you plan to structure retirement so those passions will be enhanced. I've also learned that it's not a good idea to follow the financial advise of advisers that work for large brokerage and investment houses, and it's far better to learn from the practices and habits of people that have demonstrated real financial success.