Got a little behind logging purchases into my checkbook register... started to wonder if it is even worth it anymore? Mostly just double checking that a computer can do math? The only errors I ever find are 1)mine, either writing a number down wrong or adding when I should subtract etc. or 2) a restaurant or other place does not include the tip when processing the receipt. Anymore I have even stopped getting receipts as it is easier to balance the checkbook when i log them in the same order they clear my account. I only use about 5 or 6 checks a year now... mostly just to pay things like property tax or at the DMV where they charge more to use a card.

Obviously a periodic review of your statements/accounts is a good thing just in case there is fraud etc. but that doesn't require 'full blown' checkbook balancing.

How many have given up logging checks, receipts etc. and just go by the balance the bank says you have (mentally accounting for outstanding checks etc.)?

We balance all checkbooks, all savings, and all investment accounts down to the penny as we go throughout the month. We also keep track of all credit transactions day to day throughout the month. The difference over 30 years in costs of loans and insurance between my 800+ FICO and a 700ish FICO is around $300K. $300k amortized and invested with compounding returns is literally millions of dollars.

Something I typed up because of discussion here on TBN about FICO scores that I now share with my friends and clients.

Credit Scores and You (draft)

Unless you're independently wealthy, most Americans live in a world where our credit scores matter. Yet the credit industry purposely doesn't disclose exacting percentages, numbers, or techniques needed to build credit or maintain excellent credit. Worse, many Americans scoff at the idea of taking the time to try and learn, fearing that their own independence is at stake if they were to. Yet what is to often missed by those who foster and promote such thinking is that their credit scores, over a life time, often possess the ability to make or break their personal success.

Whether we like it or not, for most of us, our credit scores effect our lives more than we know.

The people who set up the ever-changing methods to determine credit score are in my backyard (Fair Isaac Corporation) which makes my state required continuing education classes on the subject, particularly good. In my case, I just took a continuing education class for state licensing, and among the many things I learned is that a 100 point difference in credit scores for a family paying on two car loans and a $200K mortgage, with all the necessary insurances, worked out to a difference of more than $800 a month between a family with average credit and a family with good credit. Over 30 years, if the money saved was never invested and simply kept in jars, it worked out to nearly a $300,000 difference between having a 650 and 750 credit score. In other words (and this is important), the difference between credit scores can make you wealthy or poor.

Methodology to determine credit score varies depending on the type of loan. Auto loan inquiries will pull higher scores than mortgages.

Credit scores are weighted by the newest data so if you pay your bills on the first of the month, your credit score will be higher in the first week of the month, than the last week of the month. In other words, your credit score creeps down throughout the month.

More than six lines of credit can negatively effect your credit.

The longer a line of credit is in existence and current, the more it positively effects your credit score.

Credit cards, or unsecured credit, have the greatest impact on improving your credit and mortgages the least impact.

Unless you miss one payment. Payments are not late until 30 days after their due date.

Missed payments hurt people with the best credit the most.

With good credit, a single missed payment can lower your credit score by 100 points.

A single missed mortgage payment can lower a person with a good credit score by up to 150 points.

A single missed payment can negatively effect otherwise good credit for a long time, years in fact if the person doesn't have to many lines of credit. Think of it this way: a person with one line of credit is 30 days late once in three years. Such a person missed one payment in 36 payments. Another person with six lines of credit was 30 days late once in 3 years. That person missed one payment in 216 payments. The 30 day late hurts the person with 6 lines of credit for about one year, while the same late payment can hurt a person with just one line of credit for three years or more.

Credit scores are increased if the monthly average balance of unsecured credit is 20% or less of available credit per line of credit (up to 50 points). Unsecured credit that uses 50% or more of available credit can lower your score by up to 50 points.

Do not shop for the best deal interest rate wise.

A credit check, a real credit check, can knock a credit score by as much as 18 points. Do not let that jerk in the finance department keep pulling your credit with different lenders "trying" to find you financing.

Credit check pull downs last 90 days.

The older an unpaid debt is, the less it effects your credit score. Do not pay up an old debt out of some sense of doing what it right because doing so will trash your credit score by bringing forward the newest late payment. Credit score calculations do not play by the same rules as we do.

Establishing payment history is important. The longer a line of credit stays current the more it will positively effect your credit score, and the lower interest you will pay on mortgages, other loans, insurances, and frankly, because everybody checks credit score for employment these days, the more likely you are to be hired and promoted. Credit scores matter.

People with bad credit also get loans, but the way lenders manage their risk of default is by charging more and more interest. As is typical for the rest of our nation, in Minnesota our usury laws limit lenders to charging 22.9% interest on auto loans. The truly slimy lenders don't put liens on titles, and instead make loans as unsecured credit where our state usury laws allow them to charge up to 33.9% interest. Scary. And people are paying that much interest too.

With no or low credit, you should expect to pay higher interest rates. As such, the way you can manage high interest rates is by not utilizing all available credit, but exercising the credit you have every month and staying current.

Apply for your local bank's Visa or Master card--their real credit card. Use that credit card every month to pay for something like iTunes and don't carry the card around with you. Pay off the balance every month. The idea is to have monthly actively that never exceeds 20% of the total available credit.

In six months, get another credit card, go to Sam's club? Then get a Discover Card. Never use more than 20% every month of available credit and pay it off every month.

Generally, stop using debit cards. They do nothing to help improve your credit, and even though the banks say they'll back you on identity theft, they are not legally obligated to do so. Don't believe me? Wait until your account gets slammed with $10,000 of charges you never made with your debit card and all the overdrafts that come with it, and see how friendly and forgiving your bank is when your debit card finds itself in the land of the fine print. Use cash, or if you're disciplined to not overspend that 20% available credit limit, and pay off that debt every month, do use a credit card.

Getting up to a 700 credit score will be easy for you doing these things I've outlined. Getting higher credit, just means doing the same thing for a longer period of time. This is because it takes up to 10 years of good credit to get scores into the 800s.

Unless you are blessed.

By blessed, I mean you know somebody (mom and dad?) who already have excellent credit and you have no negatives or derogatory remarks on your credit report. People with awesome credit can convey their line of credit history over to people they put on their own lines of credit as either associate users or as fellow owners of the credit account. Doing so is a very good strategy to shoot a younger person's credit up very quickly, but it is risky for the person with the good credit because the young person may not share their own discipline at managing money.

Those people who cannot afford pay off all of their debts every month should put any extra funds toward paying off the highest interest line of credit first, and sending in the minimum payment plus one dollar to the rest. Why? Because your credit score calculates based on your ability to pay and paying ahead ups your score. This is true wether you pay off your entire debt, or merely one dollar more than the minimum required payment. Nevertheless, do not exceed the 20% average monthly available credit threshold if you can, and certainly do not cross the 50% of available credit threshold.

The self-employed should take special note of the following: since there is feast and famine in self-employment, if you have not done so already, pay yourself regularly in a set amount, and pay yourself first. Self employment income and some types of 1099 income is considered to be only 75% of its face value in comparison to W2 income. In other words, to a lender and their underwriting, insofar as determining loan to value in relationship to income, you only "make" 75% of what you show on your tax returns. Starting a regular payment, one that your company can afford, will show in three years time that you are a master of cash-flow management. You'll have 3 years of pay stubs, and three years of tax returns to back this up. Up your own pay only as you can afford to pay yourself and cross periods of famine, and still have the operating capital to fund your company's business expenses.

But wait: What if I've got great income, but a trashed credit score and I want to get on with my life? Here is where capitalism rears its ugly head. With the right knowledge and a skilled attorney, who will bill appropriately, it is possible to have all derogatory remarks removed from your credit report. You retain an attorney who files an identity theft report. A copy of your credit report is presented to your attorney, and your attorney drafts a document noting all negative and derogatory remarks as identity theft. Your attorney then files with document with the identity theft report with the credit reporting agencies. Expect to pay more than $10,000, some of it to your attorney and some of it to the credit agencies.

But wait: What if I don't have ten grand to spend and want to clean up negative and derogatory remarks on my credit report? Be aware that credit agencies must maintain evidence on all remarks on your credit report. Also be aware that credit agencies tend to data dump that evidence after a couple of years. As a result, after a couple of years, you can ask for verification of information. If the information cannot be verified, it must be removed by law. This includes post-marks on payments made by mail, so if you mailed in a check that was late, ask to see the envelope's post mark. If that post mark cannot be verified, ask to have the negative or derogatory remarks removed. If an agency refuses to remove the remarks, take them to small claims court, or lawyer up and sue. You will be able to sue for lost opportunity costs in addition to paying higher interest rates, higher insurance, potential passover of promotions and employment opportunities lost. A lawyer skilled in this type of law will have a field day and he or she will be your dog.

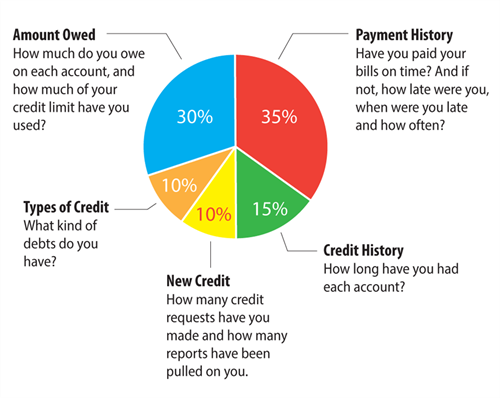

But wait: I've made all of my payments on time and all I've got is average credit! What gives? As myFICO.com explains, only 35% of your credit score is generated from payment history. The average monthly amount owed on your credit cards is the next weightiest meter used to determine your credit score followed by length of credit history, and equal measures of new credit (have you recently taken on a new line of credit or more credit from an existing line?) and types of credit (mortgage, auto, unsecured, and so forth).

Eric