You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement Planning - Lessons Learned

- Thread starter polarred21

- Start date

- Views: 213007

More options

Who Replied?

/ Retirement Planning - Lessons Learned

#741

Snobdds

Super Member

I don't agree with this reasoning, and this is why. I'm sure you're familiar with inflation calculators. Here's one:

Inflation Calculator | Find US Dollar's Value From 1913-2025

Easily calculate how the buying power of the U.S. dollar has changed from 1913 to 2025. Get inflation rates and U.S. inflation news.www.usinflationcalculator.com

It's simple to use, simply enter the $ amount and year. It tells you in today's dollars what that equals. Now, when I bought my place in 1980 my 30 year mortgage rate was 14%. At that time I was making $3.50/hr. or $11.60/hr. today. I worked my behind off and paid mortgage off in 3 years.

I just now fooled around with the calculator a bit as well as looking at homes for sale in my area. First I compared what I paid back then to today, comparing similar home+land.

That was easy, and found similar ones for comparison.

Then I tried a different way. Knowing what my payments were then the inflation calculator showed me what that would be today. Taking THAT figure at today's low mortgage rates how much home could I buy for THAT dollar amount.

I was shocked beyond belief. With that same equivalent amount I was paying back then, today I could buy not twice but about three times the place I bought in 1980.

Granted, and this is beside the point, over the years I doubled size of home, had a large garage and horse stable built, bought land, etc.

The point is all things equal, employment opportunities are everywhere. Every business around here has help wanted signs. Right now wife & I are taking horse riding lessons. The instructor comes here, he's in his late 50s, yesterday he said his is a dying breed. Younger generation doesn't want to get in to doing that, so no one to carry on.

Baby boomers (I'm 69 and wife & I are) worked hard. Our parents and grandparents worked even harder (the Greatest Generation). Make no mistake...successful baby boomers had nothing handed to them and like our parents and grandparents worked hard for what we have.

Trying to calculate nominal value at points in time is missing the point of interest rate movement and prices.

Don't try and outthink economic principles.

goeduck

Super Star Member

Maybe a new concept would be for every immigrant we take in we emigrant a drug addict. That would improve things.Watching the movie reminded me how it seems that immigrants who come to our county who have nothing, actually realize what it means to work to be paid, work hard, and try to better yourself. Say what you will about immigrants today, but from my own peresonal experience, they seem to work just as hard as most "hardworking Americans" I know.

goeduck

Super Star Member

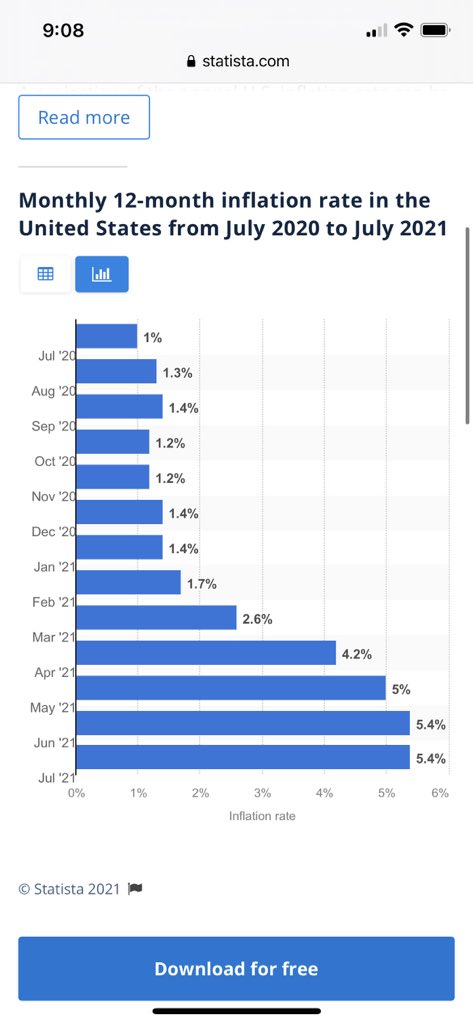

sobering thoughtThis will kill a retiree's retirement planning pretty quick if interest rates do not follow along...

Sigarms

Super Star Member

Talk about real life supply and demand...

You guys wouldn't believe what kind of long lasting effect that deep freeze in Houston has had in the HVAC industry with supply, demand and pricing.

Looking at flex manufacturing for new construction and commercial projects, and flex is hard to come by. Talked with one manufacturer, and where they once had 24 production lines running two shifts, now they're down to 11 lines running one shift a day because they're still waiting for the material to come in from Houston.

Never realized you need resin to manufacture flex duct, and the majority of that raw material came from Texas.

Been doing HVAC for close to 3 decades now, this is the first year I've seen 3 price increases from pretty much all the the HVAC manufacturers BEFORE the end of the summer of the year in question (and may have yet another before Winter). Major oil furnace manufacturer went up 22.5% in 3 months. Talking with mini split people, and now the issue is the docks in China and the price of shipping containers along with freight.

Sheet metal across the board probably around 45% up this year. PVC fittings, it's a question if you can get them, just like plastic pads.

I've never seen a year like this in my industry.

Starting to feel like I'm in the lumber market....

You guys wouldn't believe what kind of long lasting effect that deep freeze in Houston has had in the HVAC industry with supply, demand and pricing.

Looking at flex manufacturing for new construction and commercial projects, and flex is hard to come by. Talked with one manufacturer, and where they once had 24 production lines running two shifts, now they're down to 11 lines running one shift a day because they're still waiting for the material to come in from Houston.

Never realized you need resin to manufacture flex duct, and the majority of that raw material came from Texas.

Been doing HVAC for close to 3 decades now, this is the first year I've seen 3 price increases from pretty much all the the HVAC manufacturers BEFORE the end of the summer of the year in question (and may have yet another before Winter). Major oil furnace manufacturer went up 22.5% in 3 months. Talking with mini split people, and now the issue is the docks in China and the price of shipping containers along with freight.

Sheet metal across the board probably around 45% up this year. PVC fittings, it's a question if you can get them, just like plastic pads.

I've never seen a year like this in my industry.

Starting to feel like I'm in the lumber market....

RickB

Super Star Member

- Joined

- Sep 18, 2000

- Messages

- 15,190

- Location

- Up the road from Dollar General WNC

- Tractor

- Just a Scag

That's a broad statement. Index funds are 'indexed' to a wide range of specific asset classes and markets and could be dependent on the ups and downs of whatever the fund is indexed to. Conventional wisdom links the term index fund to the S&P 500 which will skew the investor's dollars disproportionately towards the tech sector. Yes, I have that type of index fund, but far, far from exclusively. At this stage of my investment cycle I am equally interested in capital preservation as growth. Even if that were not true an S&P index lacks the true asset class diversity I require. My equity/fixed income tolerance is no more than 65%. The four taxable bond funds I hold in retirement accounts have outperformed any type of cash holding since day one and continue to do so. I believe a successful bond fund management team is key to successful bond investing.Bond values and interest rates work in opposite directions. If interest rates go up, bond values will go down.

In today's world, there is no better place to put money than a low cost index fund.

Comparing an actively managed low cost bond fund to an investor watching a single bond purchase wither are two entirely different things.

10 and more years ago when I was in the accumulation phase I had exactly zero dollars in bonds of any type. Equities was king then. Now they share the stage.

Steppenwolfe

Super Member

- Joined

- Apr 11, 2012

- Messages

- 7,086

- Location

- The Blue Ridge Mountains

- Tractor

- Kubota MX5400, 1140 RTV

F'n A right on that...I don't agree with this reasoning, and this is why. I'm sure you're familiar with inflation calculators. Here's one:

Inflation Calculator | Find US Dollar's Value From 1913-2025

Easily calculate how the buying power of the U.S. dollar has changed from 1913 to 2025. Get inflation rates and U.S. inflation news.www.usinflationcalculator.com

It's simple to use, simply enter the $ amount and year. It tells you in today's dollars what that equals. Now, when I bought my place in 1980 my 30 year mortgage rate was 14%. At that time I was making $3.50/hr. or $11.60/hr. today. I worked my behind off and paid mortgage off in 3 years.

I just now fooled around with the calculator a bit as well as looking at homes for sale in my area. First I compared what I paid back then to today, comparing similar home+land.

That was easy, and found similar ones for comparison.

Then I tried a different way. Knowing what my payments were then the inflation calculator showed me what that would be today. Taking THAT figure at today's low mortgage rates how much home could I buy for THAT dollar amount.

I was shocked beyond belief. With that same equivalent amount I was paying back then, today I could buy not twice but about three times the place I bought in 1980.

Granted, and this is beside the point, over the years I doubled size of home, had a large garage and horse stable built, bought land, etc.

The point is all things equal, employment opportunities are everywhere. Every business around here has help wanted signs. Right now wife & I are taking horse riding lessons. The instructor comes here, he's in his late 50s, yesterday he said his is a dying breed. Younger generation doesn't want to get in to doing that, so no one to carry on.

Baby boomers (I'm 69 and wife & I are) worked hard. Our parents and grandparents worked even harder (the Greatest Generation). Make no mistake...successful baby boomers had nothing handed to them and like our parents and grandparents worked hard for what we have.

Steppenwolfe

Super Member

- Joined

- Apr 11, 2012

- Messages

- 7,086

- Location

- The Blue Ridge Mountains

- Tractor

- Kubota MX5400, 1140 RTV

SMStonypoint???

Steppenwolfe

Super Member

- Joined

- Apr 11, 2012

- Messages

- 7,086

- Location

- The Blue Ridge Mountains

- Tractor

- Kubota MX5400, 1140 RTV

I say let one immigrant in who wants to work, and deport 2 citizens who don't want to work...Maybe a new concept would be for every immigrant we take in we emigrant a drug addict. That would improve things.

goeduck

Super Star Member

^^ even betterI say let one immigrant in who wants to work, and deport 2 citizens who don't want to work...

Steppenwolfe

Super Member

- Joined

- Apr 11, 2012

- Messages

- 7,086

- Location

- The Blue Ridge Mountains

- Tractor

- Kubota MX5400, 1140 RTV

Yep... and we get to a better America faster...^^ even better

GMIslander

Silver Member

When I was 18, right out of high school I started a three month job as a temp diesel power plant operator. Forty seven years and three trades later I left. Their still paying me. No on call and no overtime=retirement.

newbury

Super Star Member

- Joined

- Jan 8, 2009

- Messages

- 14,842

- Location

- From Vt, in Va, retiring to MS

- Tractor

- Kubota's - B7610, M4700

"Lived through" and "experienced it as a mature individual" can be far different.I became a legal adult in 1979. I've lived through worse. So have most of you.

View attachment 712741

When my children (born after'81') complain about high interest rates I remind them we fought to get a home loan at 12% in 1984 so they could grow up in the $114K house we've lived in since then. Now valued at about $650K.

This current retiree is looking seriously at refinancing quite a bit at the 2% rate my mortgage holder is offering.<snip>

From my stand point, I am cheering on inflation and hoping interest rates move up. This should cause asset prices to come down and later on down the road an opportunity to refiance to a lower rate to cash in on some interest equity. I know this sucks for current retirees', but you had you turn at the trough.

Yup, picked up the 3 bedroom house in town for $25K cash. But "rock bottom" rates were still around 3.5%, WAY higher than todays rates. Was cheaper than a storage unit. Or so I convinced my wife. We needed a storage area for our furniture. We really need to fix it up. Zillow now values it at over $100K.You don't need inflation and high interest rates to make assets cheap, all you need is for the economy to take a dump. Just 10 years ago you could have picked up houses at half price mortgaged at rock bottom rates. I was telling anyone who would listen to buy a house on a 30 year fixed, because they would look like financial wizards ten years later.

<snip>

I've been planning on the economy taking another dump for years.

- Joined

- Aug 31, 2001

- Messages

- 66,099

- Location

- South Bend, Indiana (near)

- Tractor

- Power Trac PT425 2001 Model Year

We bought our first house in 1985. Paid 3 points to get it down to 12.5%. Paid it off in less than 5 years. Bought 20 acres of vacant land. Paid that off in about 4 years. Bought our current house around 1994 and paid that off around 1995. Been debt free ever since. We both put 15% of our income into IRAs and 401Ks as soon as possible. So 30ish years of investing 15% of our income with both of us making average wages coupled with compound interest... we're not complaining. Our houses were modest and the market here has never been for much growth in home prices (this year excluded). We never considered our houses as investments, just a way to get our rent money back if we sold. The house we live in has not doubled in price since we bought it in 1994. The value of our house makes up less than 10% of our net worth. So I think of it this way. We could have bought expensive real estate and had less cash or we could have bought cheap real estate and had more cash, and still probably ended up with the same net worth in this area. HOWEVER, if the poop hits the fan, we'd have to sell an expensive house to access cash, whereas the situation we are in now (and have been in since we said "I Do") is that we would never have to sell our house to access cash, and can pay all of our bills on two people making minimum wage (probably even less, now)."Lived through" and "experienced it as a mature individual" can be far different.

When my children (born after'81') complain about high interest rates I remind them we fought to get a home loan at 12% in 1984 so they could grow up in the $114K house we've lived in since then. Now valued at about $650K.

...

I'm 60 (and thankful).

newbury

Super Star Member

- Joined

- Jan 8, 2009

- Messages

- 14,842

- Location

- From Vt, in Va, retiring to MS

- Tractor

- Kubota's - B7610, M4700

But the main thing is - did you have fun so far?We bought our first house in 1985. <snip>

I'm 60 (and thankful).

I think of life as a roller coaster ride, I enjoy the ups an downs, I just don't look forward to the end of the ride.

kenmac

Super Member

- Joined

- Feb 13, 2005

- Messages

- 9,898

- Location

- The Heart of Dixie

- Tractor

- McCormick CX105 Kubota MX 5100 HST,

Great to hear all these war stories.. I inherited a bundle when my parents died. Never had to work very hard !

Never had to work very hard !

This year, I have begun to take some money out of the market, and invest in a few private equities. We shall see how it all goes

This year, I have begun to take some money out of the market, and invest in a few private equities. We shall see how it all goes

Fuddy1952

Elite Member

- Joined

- Apr 17, 2018

- Messages

- 4,332

- Location

- South Central Virginia

- Tractor

- 1973 Economy and 2018 John Deere 3038E

?!?!?Trying to calculate nominal value at points in time is missing the point of interest rate movement and prices.

Don't try and outthink economic principles.

First, I mean no disrespect Snobdds.

I'm simply comparing a 1980 Macintosh apple to an 2021 Macintosh apple.

Economic principles would have to include dollar valuation and time.

I never took Economics but I'd like to believe I have common sense.

Gold is gold, same 2000 years ago as it is today...pure gold.

In 1980 an ounce of gold closed at $594.90 per ounce. Today it closed at $1,830.00 per ounce.

So let's say in 1980 my home mortgage was $500/month.

Today that's equivalent to $1,656.57/month.

Now look at my attachment. That's using today's current 2.864% mortgage interest rate, 30 year fixed loan which relates to a $400,000 mortgage loan amount. THIS is just a quick search example of what a $400,000 home is for sale near me.

Believe me...it's lightyears a far better home than the 1,000 sq.ft. 80y.o. home I bought in 1980...that needed well pump, all new wiring, all new plumbing, a "kitchen" with a sink cabinet, one bedroom one bath, and needed new shingles!

Now...it's your turn explaining my flawed logic. Again...no disrespect on my part...teach me economic principles.

- Joined

- Aug 31, 2001

- Messages

- 66,099

- Location

- South Bend, Indiana (near)

- Tractor

- Power Trac PT425 2001 Model Year

Heck yes!But the main thing is - did you have fun so far?

I think of life as a roller coaster ride, I enjoy the ups an downs, I just don't look forward to the end of the ride.

Fuddy1952

Elite Member

- Joined

- Apr 17, 2018

- Messages

- 4,332

- Location

- South Central Virginia

- Tractor

- 1973 Economy and 2018 John Deere 3038E

Mossy=a smart fellow!We bought our first house in 1985. Paid 3 points to get it down to 12.5%. Paid it off in less than 5 years. Bought 20 acres of vacant land. Paid that off in about 4 years. Bought our current house around 1994 and paid that off around 1995. Been debt free ever since. We both put 15% of our income into IRAs and 401Ks as soon as possible. So 30ish years of investing 15% of our income with both of us making average wages coupled with compound interest... we're not complaining. Our houses were modest and the market here has never been for much growth in home prices (this year excluded). We never considered our houses as investments, just a way to get our rent money back if we sold. The house we live in has not doubled in price since we bought it in 1994. The value of our house makes up less than 10% of our net worth. So I think of it this way. We could have bought expensive real estate and had less cash or we could have bought cheap real estate and had more cash, and still probably ended up with the same net worth in this area. HOWEVER, if the poop hits the fan, we'd have to sell an expensive house to access cash, whereas the situation we are in now (and have been in since we said "I Do") is that we would never have to sell our house to access cash, and can pay all of our bills on two people making minimum wage (probably even less, now).

I'm 60 (and thankful).

I bet Mrs. Moss is smart as well!

You did well.

I have been retired 17 years. I guess I have learned that the amount of money you have monthly during retirement is important, but the amount you spend may be more important. It is important to pay off those bills before you decide to retire.