California

Super Star Member

- Joined

- Jan 22, 2004

- Messages

- 16,651

- Location

- An hour north of San Francisco

- Tractor

- Yanmar YM240 Yanmar YM186D

re helping manage a relative's money, the smartest thing I ever did was get Dad's variety of investments moved into a single Fidelity master account. He had a whole bookcase of original stock certificates, dividend-reinvestment statements, elections of corporate directors, more. He paniced when he noticed he was no longer getting statements from the spun-off PacTel cellphone division. (Because that entity had been sold to Vodaphone). At age 85 he asked for my help to resolve this. I knew I would eventually be executor so I talked him into taking all his paperwork to Fidelity to figure out. This put everything on a single monthly summary statement. A few years later, settling the financial part of his estate was simple.

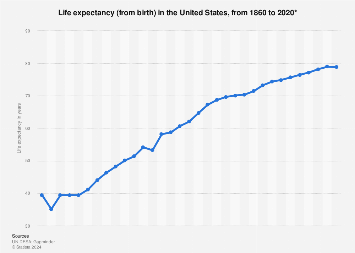

. Insurance companies have some startling facts about our longevity right now.

. Insurance companies have some startling facts about our longevity right now.