The pandemic certainly curtailed banking with many local branches closed over a year and by appointment when reopened until fairly recently.

Banks are again open but making cash and/or “Large” deposit is not business as usual and now cause for extra scrutiny and holds up to 15 days… crazy when computers are able speed operations in the blink of an eye.

I still run my small property management company of 40 years and rent is typically paid by check or electronic transfer… or cash if rent in arrears or past check with issues

By law up to 3 years unpaid pandemic rent cannot be reason for eviction.

I have been doing business for over 50 years with Bank of America and US Bank… never a bounced check drawn on any of my accounts ever.

One of my very behind tenants sold his car and gave me $3,000 in cash on 14k back rent he owes.

Went to deposit at my branch and it took the branch manager approval to accept the cash deposit to my Property Management Business Account with the reason being a crackdown on cash deposits…???

“Cash is King” seems to no longer be the case…

The Bank also gave me a printed notice that a Account Hold may be placed on accounts where total deposited checks total more than $5,525 in a day…

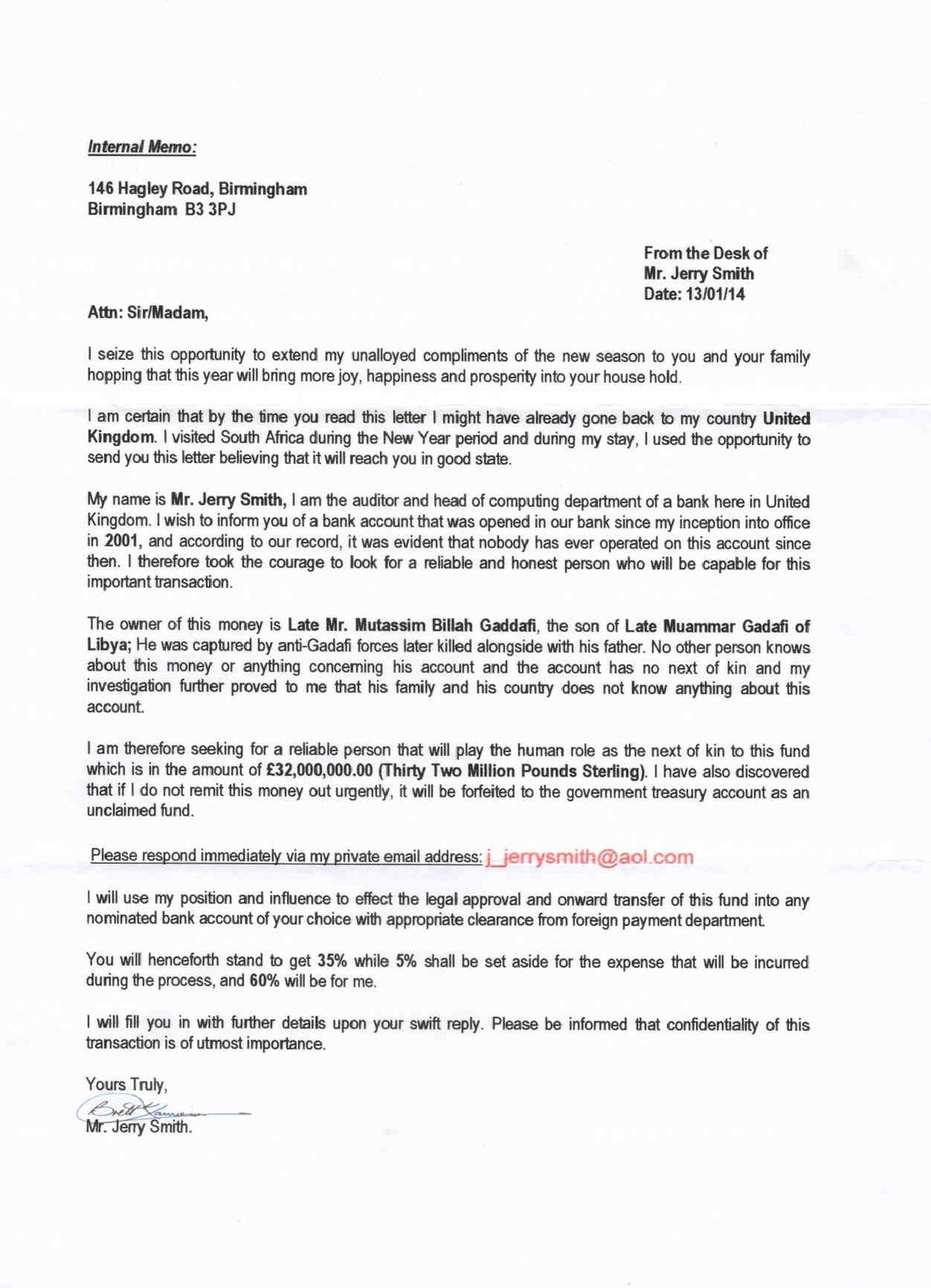

On a related note I deposited my personal check of $2500 to a family joint account to cover up coming estate incidental expenses without issue and later that day received this email stating:

| $2,500.00 | |

| Hold reason: | A 15 day hold was placed on your check(s) because check specific information indicates item may be returned |

Interesting times we live and nothing gets easier when running a business…