Yours sounds high.

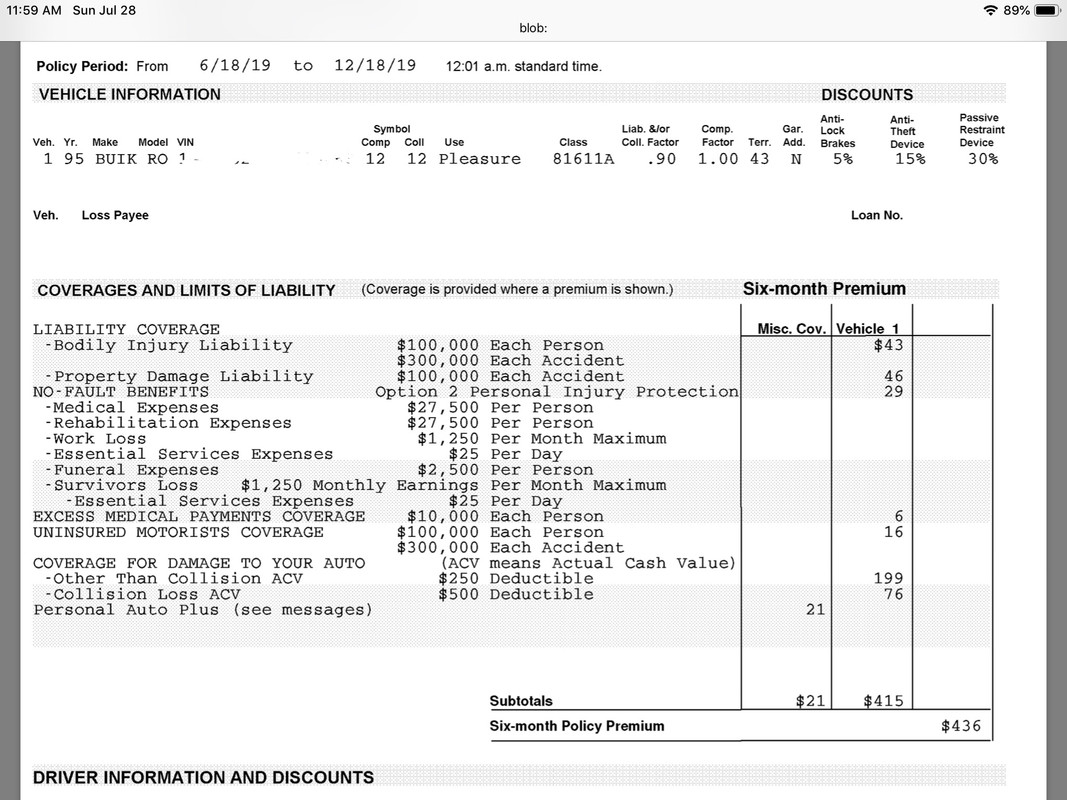

I pay $872.00, per year, for my 1995 Buick Roadmaster. Full coverage $500 deductible on collision, $250 deductible on everything else.

I also have a commercial policy, full coverage $500 deductible on my 2014 F-350 crew cab flatbed dually and 2018 Diamond C dump trailer. This cost is $1,195.00, per year.

I pay $872.00, per year, for my 1995 Buick Roadmaster. Full coverage $500 deductible on collision, $250 deductible on everything else.

I also have a commercial policy, full coverage $500 deductible on my 2014 F-350 crew cab flatbed dually and 2018 Diamond C dump trailer. This cost is $1,195.00, per year.