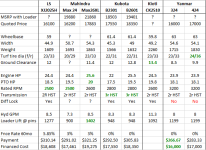

Visited Mahindra again this weekend. Checked out the max 26xl. The pedal layout is not ideal. The loader capacity though is better than anything else in the price range.

Was surprised at all the financing "options." Options in quotes because I think its dishonest the way they advertise it. The price of the tractor increases for every financing option. Rather than just tell you they are charging 6% interest, they add the interest cost to the base price and then tell you the financing is 0%.

After building the house I am not going to be able to make a cash purchase, so financing will be key. Seems ridiculous to have to pay 6% on a loan right now but that's where I'm at with both Mahindra and LS. Kubota guy quoted me a price and said there is 0% financing, which I took to mean it was available at the quoted price, but I guess I'll have to follow up and clarify.

Aren't there any 3rd party financing options for tractors? I couldn't find anything. Can get a car loan for 2% anywhere, why nothing for tractors? 6% sucks.

Lastly I emailed the Yanmar dealer on the 424 - seems equivalent to the others I'm looking at except no locking differential which seems to be a really basic exclusion. Also emailed JD dealer on 2025r. Again, seems like a competitor so i might as well get a quote and check it out.