DarkBlack

Elite Member

I won’t debate your statistics, but I will, your conclusion. Your conclusion fails to account for many new vehicle purchases either partially, or totally hinge on selling the existing vehicle.You make a good point, but I think your particular demographic is a new one, with the boomers now retiring. Look at your parents generations, retirees were not known for buying new cars in the past. Hell, we used to joke you could pick them out because of the old wrecks they drove.

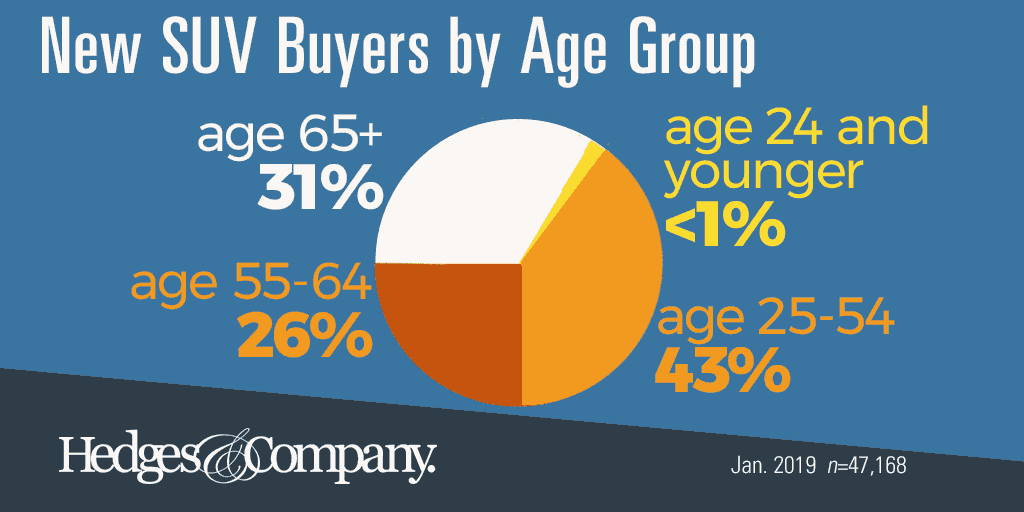

Sources do show the average age of a new car buyer creeping up, from mid-40's in the early 2000's to over 50 post-COVID, with speculation this change was caused by increasing prices. But one thing that hasn't changed much is that 90% - 93% of new car buyers own their home:

New trucks: 93% own their home

New SUV's: 93% own their home

New sedans: 90% own their home

Again, a car manufacturer is making cars primarily for the people who buy new cars. Concerns over how an apartment dweller might charge their EV are likely not at the top of their list, if only 7% - 10% of new car buyers are renters, and only a fraction of renters are in apartments versus rented houses.

Automotive Trends: New Car Buyer Demographics

Demographics of new car and truck buyers. Who buys new cars or trucks? See new car demographics by age, income, gender and more.hedgescompany.com

The existing vehicle may be ICE, or may be an EV. In either case, it takes the desire of someone ( dealer to apartment dweller, or apartment dweller directly ) to pay for your existing vehicle to upgrade to new.

If apartment dwellers can’t easily charge a second hand EV, then that hurts the secondary market and indirectly hurts new vehicle sales.

I believe big car companies are in fact, cognizant of their vehicle’s used market demographics and values