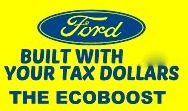

The joke is that US Treasury bailouts have always created revenue for the Treasury and limited damage to the downside by retaining jobs. Perspectives on the issue vary: Investors like it when everything crashes quickly and hard as such things put everything under the sun on fire sale (due to a lack of anybody willing to spend or deploy money) and provide the ground work for speedy recoveries, whereas bailouts tend to put crashes into slow-motion and then function to dampen the depth of economic devastation, while for common Joes and the poor, crashes simply lower their quality of life. Ironically, since financial theory isn't taught, the very people most helped by bailouts also were the most vocal against them. This irony amusing me to no end (especially when most people lumped auto bailouts with banking backstops), and thus I put no bailout addition on my truck.